Digital currencies, also known as cryptocurrencies, have become increasingly popular over the past few years, and for many investors, these assets have become an integral part of their financial portfolios. But, like any other valuable asset, it’s important to consider what will happen to your digital currencies when you die. This is where estate planning comes in.

Estate planning is the process of creating a plan for what will happen to your assets when you die. In this article, we’ll take a look at the key considerations for estate planning for digital currency.

Determine the Value of Your Digital Currency

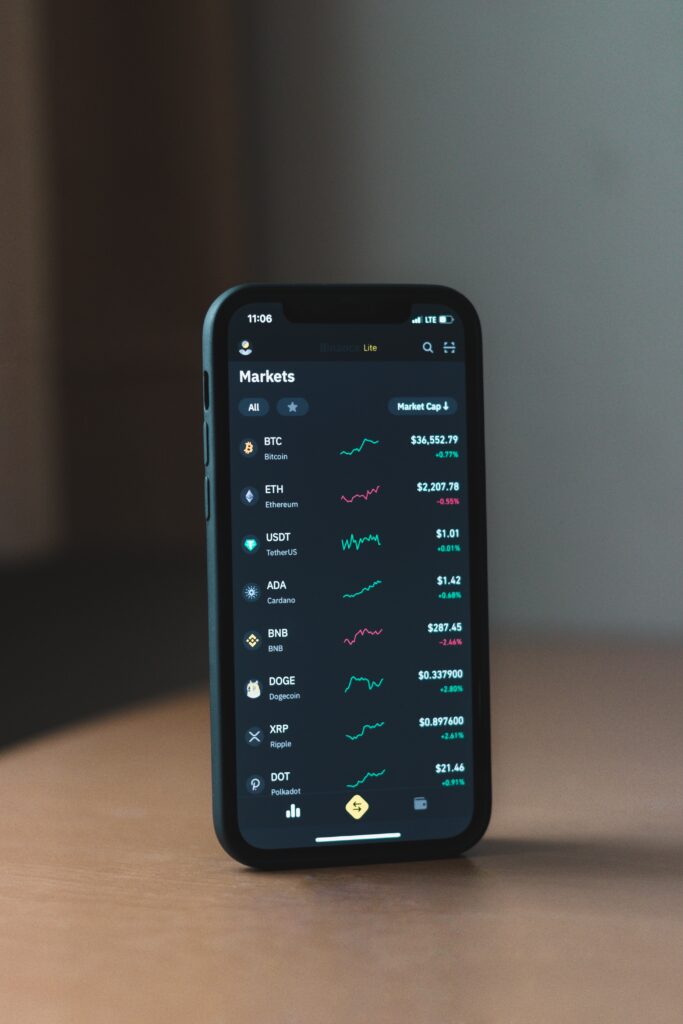

The first step in estate planning for digital currency is to determine how to determine the value of your holdings. The value of digital currencies can fluctuate rapidly, so it’s important to get an accurate valuation mechanism.

Create a Will

A will is a legally binding document that specifies how your assets will be distributed after your death. If you own digital currency, it’s important to include it in your will so that your wishes for how it should be distributed are known.

Appoint an Executor

An executor is the person responsible for carrying out the terms of your will. When creating your estate plan, consider who you would like to appoint as the executor of your digital currency. It’s important to choose someone who is trustworthy, responsible and has a basic understanding of digital currencies.

Choose a Secure Storage Method

Digital currencies are stored in digital wallets. It’s important to choose a secure storage method for your digital currency, such as a hardware wallet, and to make sure that your executor knows how to access it. A good way to do this is provide the information in your Gentreo Digital Vault. You should also consider creating a backup of your digital wallet in case it is lost or stolen.

Communicate Your Estate Plan

Finally, it’s important to communicate your estate plan to your executor and any other relevant parties. Make sure that they have all the information they need to carry out your wishes after your death.

In conclusion, estate planning for digital currency is an important step in ensuring that your assets are handled properly after your death. By taking the time to consider the key considerations outlined in this article, you can rest assured that your digital currency will be handled in accordance with your wishes.