The Ultimate Guide: Death of a Loved One

In the wake of a loved one’s passing, it can seem impossible to do daily tasks, let alone essential long term planning goals.

When a loved one dies without taking the necessary precautions, their loved ones will be tasked with practical matters on top of the emotional distress. Locating any will and/or trust documents; making disposition of bodily remains choices; and trying to track down assets, debts, and insurance, to name a few. All of these tasks are already cumbersome, but so much more so under the stress of a loved one’s passing.

Get the FREE Guide!

Enter your email address to download our FREE guide that covers the things you need to do to update your estate planning documents after a loved one passes away.

While there are no changes or updates to be made to a loved one’s documents after they’ve died, it is an opportunity to review your own documents, particularly if the deceased is named as an agent or beneficiary in your estate plan. Your new health care and/or financial agent will need to know where all the original documents are stored and how to quickly access them in an emergency. You also may need to change your beneficiary statements in light of your loved one’s death and possibly consider re-evaluating your additional insurance coverage.

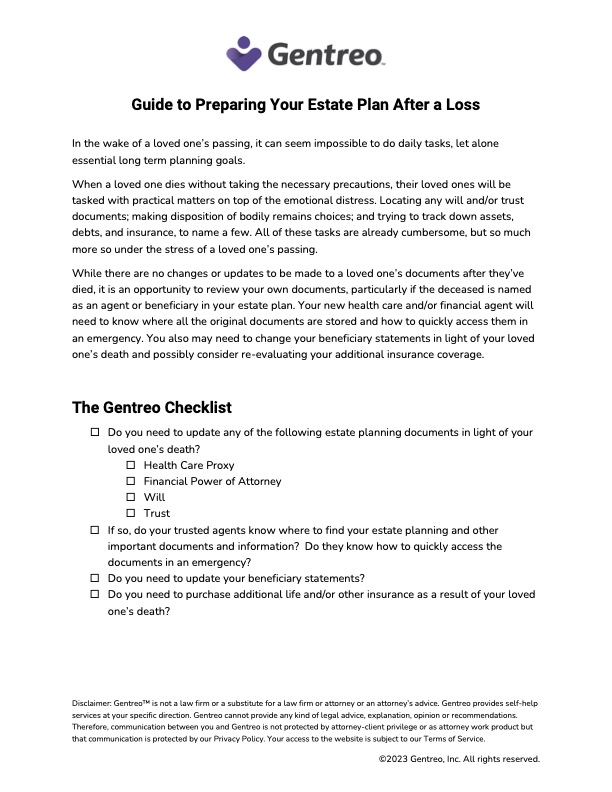

Checklist

- Do you need to update any of the following estate planning documents in light of your loved one’s death?

- Health Care Proxy

- Financial Power of Attorney

- Will

- Trust

- If so, do your trusted agents know where to find your estate planning and other important documents and information? Do they know how to quickly access the documents in an emergency?

- Do you need to update your beneficiary statements?

- Do you need to purchase additional life and/or other insurance as a result of your loved one’s death?